Online business loan calculators make it easy to do complex calculations for small business loans like how much interest expenses will be each year, or what amount of new debt a company can absorb. But they can only help small business owners make strategic decisions if they’re used properly, including:

- Checking how much financing a lender may approve.

- Comparing how different types of loans will fit with a company’s needs instead of only comparing different rates or terms for the same loan type.

- Using calculators together with spreadsheets to plan and evaluate advanced scenarios like using a combination of loan types to match loan payments to cash flow needs or benefit from interest rate changes over time.

Note: Business loan calculators can typically help you make business decisions when using numbers and scenarios that lenders are more likely to approve. This can include:

- A small business owner with a fair business credit score vs. a great one who won’t qualify for the lowest advertised interest rate or the highest loan amount. This business owner needs to add numbers that reflect their situation.

- New businesses without collateral that won’t qualify for big unsecured loans without 3+ years of growing financial statements or that won’t have enough collateral for large secured loans.

Online calculators can only figure out accurate monthly payments, interest expenses, and other numbers when you give them accurate data. By being realistic with your numbers, you will be able to make a good decision. This also means you won’t have to mess around with complicated finance formulas.

If you’re considering a small business loan or need new funding solutions, here’s how to use online business loan calculators the right way.

Affordable Versus Approvable Loans

Business loan calculators tell you if a loan is affordable based on the numbers you input, but they don’t know details of your other debts or the terms for a new loan, meaning they can’t tell you if you’re likely to be approved for the interest rate or loan amount you’re putting in.

Here are some of the items a business loan calculator will not know without you putting the information in:

- Whether a company would qualify for the interest rate, loan amount, or other specific terms like collateral or curtailment penalty removals

- That lenders often require a buffer in cash flow to make sure any negative hit to revenue won’t cause missed payments

By not having these inputs, business loan calculators make small business owners think they can get approved for larger loan amounts than what is realistic. To get better numbers for a calculator, get an updated business credit report directly from Dun & Bradstreet, Equifax, or Experian.

Don’t worry, this won’t create a hard inquiry that impacts your business credit score. Then talk with a couple of loan officers to get average numbers for your credit score. Use these numbers when working with the business loan calculator.

Lenders also require a buffer for available cash flows, including new loan payments, to make sure a small revenue decline won’t cause a borrower to miss payments. They use cash flow instead of profits because principal payments aren’t deducted from revenue as an expense and don’t impact profit, but they do impact cash flow.

This is why banks evaluate a borrower’s risk using ratios like the Debt Service Coverage Ratio (DSCR), which shows the buffer a company has available to keep making payments if revenue drops. The formula is:

- DSCR = Earnings before Interest, Taxes, or Depreciation & Amortization (EBITDA) / Total Debt Payments (P&I)

Lenders want a minimum DSCR of 1.25, meaning the business’s EBITDA must be 1.25 times higher than P&I including the new payments. Small business owners go wrong by ignoring the DSCR ratio and by not including the new payments in total P&I.

If your business has the following numbers, your DSCR will be 3.23:

- Net Income = $100K

- Taxes Paid = $20K

- Interest Expense = $24K

- Depreciation = $50K

Use the calculator below to put in your own numbers and find out your company’s debt service coverage ratio. Use yearly numbers from your income statement except for monthly total debt payments.

Even though your monthly EBITDA in this example is $16,166.67 and your monthly debt payments are $5,000, it doesn’t mean small business lenders will approve another $10K-per-month loan because that would lower your DSCR too much.

This calculator tells you how much more you can cover in P&I to keep your debt service ratio above a required number. To keep DSCR above 1.25 in this example, you can only afford another $7,933.33. If lenders require 1.5, your affordability drops to $5,777.78. Enter your own numbers and slide the DSCR to see what you may qualify for.

This calculator also helps you plan for future situations to know if you’ll have a problem with your DSCR. If next year’s revenue drops to $70K and taxes work out to be $14K, then your DSCR drops from 3.23 to 2.63 and you’ll only be able to afford another $5,533 in loan payments without getting into trouble (assuming the min DSCR isn’t higher than 1.25). Try stress testing your own numbers for changes in revenue and see how that changes your ability to get a new small business loan.

Compare Loan Types for Strategic Decisions

By using business loan calculators to compare different types of business loans you’ll be able to choose the right financing option for your needs.

If you need to borrow $100,000 to build a new production line because you landed a large new customer and you have the two loan options below, which should you choose?

- Factor rate loan for 30 months with factor rate of 1.2

- Standard term loan for 60 months with 11% interest rate

Some online loan calculators let you compare loans with different rates or payback periods, which doesn’t help compare a factor rate versus a term loan. But the calculator below tells you how much each loan costs side by side, so that you can choose what works best for your strategy:

- The factor rate of $20,000 costs less than the total interest on the term loan of $30,455, which makes the factor rate loan better if your focus is total cost of debt. The factor rate loan also gives you flexibility to pay different amounts each month, letting you get the production line set up and being able to start collecting invoice payments before you must make large monthly payments.

- The term loan is better if the most important thing is to keep average monthly payments as low as possible. You’ll have to start payments immediately, but payments will be $2,174 since they’re spread out equally over 60 months. With the factor loan, you could pay a couple hundred dollars for the first year, but they would increase later and your average across the entire loan would be $4K.

Advanced Scenario Planning

When a business needs to plan for advanced scenarios including loans and tax implications, online calculators won’t be flexible enough for the full scenario, but they come in handy to quickly calculate spreadsheet inputs and double check math for accuracy.

Using a spreadsheet like this one with built-in formulas lets you compare loan types in combination across multiple years and figure in tax savings to determine the full impact of one financing decision over another. If you don’t know how to write formulas in spreadsheets, online calculators help you with the complex math so you only must set up the spreadsheet and enter the numbers.

Let’s walk through an example together:

- You need $50,000 because you landed another huge client and need more raw materials and to hire staff to fulfill the contract. There are 2 funding options available right now:

- Tap your line of credit (LOC) charging 10% for $50K.

- Get a small business loan for 5 years at 12%.

If you treat the $50K from your line like a bank loan and stick to regular monthly payments, then it’s better since the interest rate is lower. That means you must be disciplined to make regular payments on both principal and interest each month regardless of whether sales were down a bit, vendors increased prices suddenly, or any other reason that cuts into cash flow. That also eats into cash flow you could use for other growth opportunities before your new customer starts paying invoices.

Another option is to tap your LOC for $50K immediately. Pay interest only for 2 years so you can reinvest cash flow into faster growth while growing your new customer’s account. Then pay off the line in 2 years when rates drop. Here’s a quick 4-step process for you to use online calculators together with a spreadsheet to compare scenarios:

- Set up your spreadsheet (you can download this one which is already set up for scenarios in this example).

- Find the right online calculator for each type of funding in your spreadsheet.

- Gather key data points for each type of funding.

- Let the calculators do the complex math and add the numbers to your spreadsheet to compare options.

Here’s how this works step by step.

Spreadsheet Setup

There’s no right or wrong way to set up a spreadsheet, as long as you can refer back to it and easily understand what you did.

Here are the 3 loan types in the spreadsheet plus one column that adds two of the loans together:

- Line of Credit is where you pay interest only.

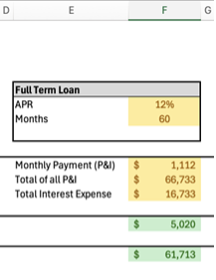

- Full Term Loan is the 5-year standard small business loan.

- LOC Payoff Loan is the business loan you get at a later date when rates drop to pay off your LOC outstanding balance.

- Line of Credit + Payoff Loan adds up the Line of Credit and LOC Payoff Loan amounts.

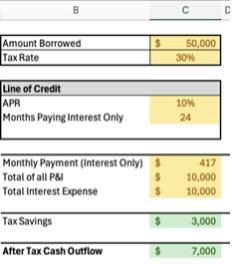

You’ll enter numbers into the yellow cells and the sheet has these formulas prefilled in the green cells:

- Months (under LOC Payoff Loan) is automatically calculated based on the length of the full-term loan and how long you wait to pay off the LOC. The formula is:

- Months (under LOC Payoff Loan) = Months of full-term loan – Months paying interest only on LOC

- Tax savings is the expected cash saved by writing off interest expense on your income statement. The formula is

- Tax Savings = Tax Rate x Total Interest Expense

- After tax cash outflow is the total net cash outflow from your business each year and the formula is:

- After Tax Cash Outflow = Total of all Principal and Interest (P&I) – Tax Savings

Once you set up your spreadsheet, you’re ready to find online calculators.

Find the Right Online Calculator

Finding the right calculator to use is crucial when you need more than a standard business loan amortization because details like daily versus monthly compounding, fees that get wrapped into the loan, and variable rates could mean a difference of $1000s. You’ll need two calculators for this example:

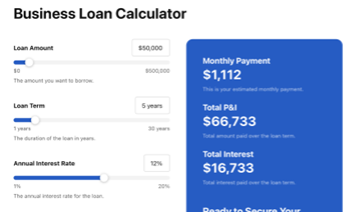

- Standard business loan calculator for the 5-year term loan and the LOC payoff loan.

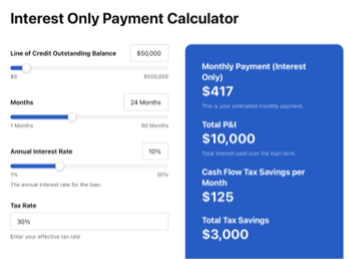

- Interest only payment calculator. The one below also includes tax savings calculations, letting you double check any formulas you put into the spreadsheet.

Gather Key Data

Gathering key data points is more than doing a quick Google search for current loan rates. It means checking your business credit score, doing a stress test on your debt levels like in the first section of this article, and researching where interest rates are likely to go in the future.

This gives you realistic expectations of how much lenders will approve you for, at what interest rate, and for how long, so you don’t waste time doing lots of math for loans you’re not likely to be approved for.

Math with Calculators to Compare Options in Spreadsheet

Using online calculators to do complex math lets you quickly enter numbers in your spreadsheet to compare scenarios and choose the right one. Realistic estimates for interest rates, loan amounts, and your effective tax rates from the previous step are crucial so that you don’t waste time comparing options you likely won’t qualify for.

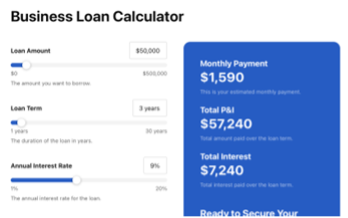

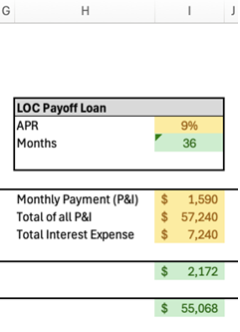

The online calculators do complex calculations, so you just need to input numbers into the spreadsheet. Here’s a side by side of what you’ll see on the calculator and where to put numbers in the spreadsheet:

Total P&I and Interest Expense are the same for the Line of Credit calculator since you’re paying interest only in this example. Double check that the total tax savings on the calculator match your spreadsheet:

Use the standard business loan calculator for the 5-year loan:

Use the standard business loan calculator for the LOC Payoff loan. This is where your estimate of future rates coming down comes in. Be sure to change the loan term in the calculator to match the spreadsheet:

Once the scenarios are in your spreadsheet, it gives you a side-by-side look at the overall cost of the options in addition to their tax benefits. Using the line of credit interest only for the first two years, and then paying it off with a 3-year loan after rates come down, only costs $507 more than the standard 5-year loan. And that drops to $355 after the tax benefits. Your cash flow for the first two years will also be much higher, letting you reinvest to speed up growth.

If rates don’t drop as expected, you could treat the line as a regular loan at 10% for the final 3 years. Put those numbers into the online calculator and you’ll see that paying the first 2 years at interest only and then paying off the line of credit over the final 3 years costs only $944 more than the standard term loan after taxes and can be well worth the added cash flow in the first two years.

By using online business loan calculators to make informed business decisions, you’ll get realistic numbers that tell you what lenders may approve you for and you’ll be able to compare different types of loans and combinations of loans in advanced scenarios. If you’re looking for financing, click here and fill out our form to get matched with a top financial provider.

SmallBusinessLoans does not provide tax, legal or accounting advice. This material has been prepared for informational purposes only. You should consult your own tax, legal and accounting advisors.